1000minds in Europe

1000minds now has an application instance in the European Union with all data storage and processing performed in the EU.

Keep up with 1000minds news, industry updates, and solutions.

1000minds now has an application instance in the European Union with all data storage and processing performed in the EU.

Project selection is the process of evaluating potential projects and choosing the ones that are most likely to deliver the desired outcomes and benefits. It involves identifying the projects that align with an organization’s strategic goals, mission and vision.

As countries around the world strive to reduce their carbon footprint, a new study uses 1000minds to assesses alternative approaches for decarbonizing electricity generation in a large-scale industrial context.

Human-in-the-Loop (HITL) decision-making combines human expertise with AI algorithms to improve outcomes. HITL has applications in various domains such as healthcare, cybersecurity, finance, and more.

The New Zealand Institute of Economic Research (NZIER), commissioned by the New Zealand Defence Force, used 1000minds preferences surveys to investigate how New Zealanders value the country’s naval combat force.

1000minds decision-making software now includes an AI assistant powered by OpenAI services – but keeps you in the driver’s seat.

Improving food security through crop breeding means that farmers must be willing to adopt improved crop varieties. 1000minds was used to understand which cassava traits are preferred by African farmers.

A new tool to rate gardens on their level of biodiversity could have key implications for building more ecologically sustainable cities in an increasingly urbanized world.

A 1000minds conjoint analysis survey was used to find out how Covid-19 experts feel about the relative importance of possible lockdown features in terms of how they are experienced.

1000minds played a key role in Dunedin City Council’s (DCC) and WSP’s St Clair to St Kilda Coastal Plan engagement project, which was awarded “Australasian Project of the Year”.

Managers of controversial wildlife interaction facilities, such as lion farms and petting zoos, can use the tool to assess if cubs are cared for in an ethical way.

Despite the ‘intelligence’ demonstrated by machine learning algorithms, blindly trusting them can lead to dangerous decision-making. How does the 1000minds PAPRIKA method relate to machine learning?

Daniel Kahneman’s latest book, "Noise: A Flaw in Human Judgment", reveals the enormous variability – ‘noise’ – in experts’ judgments and recommends using criteria and weights for decision-making.

1000minds was used to discover people’s preferences with respect to the relative importance of the main attributes associated with electric relative to petrol/diesel vehicles.

1000minds is proud to offer two $2000 USD scholarships each year to post-graduate students worldwide for research projects involving decision-making or conjoint analysis.

The course compiles our tutorial videos, packaged together with exercises and quizzes to help you learn how to use 1000minds to make reliable and effective decisions.

Participants were presented a 1000minds conjoint analysis survey with the goal of figuring out which characteristics matter most when donating money to international charities.

1000minds is excited to offer a new webinar for health professionals, administrators, and policy-makers based in the western hemisphere

1000minds was used to rapidly develop a decision-support tool for prioritizing Covid-19 patients for admission to intensive care units (ICUs).

Legalizing the trade in rhino horn could be beneficial for the welfare of rhinoceros, a study using 1000minds shows.

To support countries battling the pandemic, 1000minds has made available a tool to help with prioritizing people to receive Covid-19 vaccinations.

1000minds was used to develop a national prioritization tool for elective general surgery in New Zealand, which could be applicable to other OECD countries.

1000minds was used to create an online tool for prioritizing Covid-19 patients for intensive care (e.g. respirators, life support) if ICUs are overwhelmed.

"Choices are the hinges of destiny.” (Pythagoras, c. 500 BC)... Can we help people make better ones? Join Paul for his Inaugural Professorial Lecture.

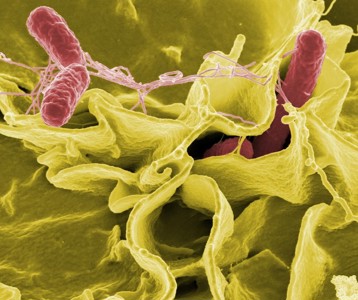

The World Health Organization used 1000minds to create a Priority Pathogens List (PPL) of antibiotic-resistant bacteria to support R&D into new and effective drugs.

Created using 1000minds, the World Health Organization published a list of antibiotic-resistant diseases to help prioritize R&D into new antibiotics globally.

A Problem Solved – an article in Country-Wide magazine, February 2013, about a New Zealand-created software program, 1000minds, going global.

New Zealand company Graduate Factory has come up with a solution to one of the most important decisions in a person's life: What should you major in at university?

Next week around 40 scientists and policymakers will meet in Wellington to familiarise themselves with the principles behind geoengineering.

The power of 1000minds is that farmers can use it to reveal otherwise hidden factors that have a significant impact on profit and they can then focus selection more on these traits.

If you had to rank 14 health treatments ranging from hip replacements to drugs for erectile dysfunction according to their benefit or value to society, how would you do it?

New software developed in New Zealand and improved in Israel for choosing medications for the health basket.

1000minds is a finalist for the TUANZ Education Award 2009.

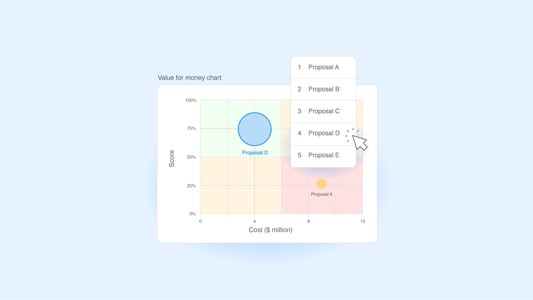

New features in 1000minds help the private sector and government decision-makers get better ‘value-for-money’ when allocating scarce resources across competing alternative uses.

Air quality is one of the major concerns people have concerning a $300 million cement plant being built at Weston, near Oamaru, according to information being gathered by Ngaio Fletcher.

Otago Choice (based on 1000minds technology) launched at Otago University to help students choose subjects to major in.

Paul Hansen is something of a rock star in Dunedin's academic and entrepreneurial communities.

1000minds wins a Consensus Software Award

1000minds is a finalist for the 2006 Westpac Otago Chamber of Commerce Business Excellence Awards.

Deciding who gets publicly-funded heart surgery is difficult but the use of world-class internet based software is providing a fairer system for patients.

1000minds, a program designed at the School of Business to help people and organizations make optimum decisions, continues to reap awards.

The owners of an award-winning software program that aids decision-making by ranking user preferences is trying to crack the growing US homeland security market.

1000minds at the Asian Wall St Journal's Asian innovation awards, Asia's premier honour for individuals and companies whose ideas improve the quality of life or productivity.

The finalists for the Global Entrepolis @ Singapore award come from distinctly different backgrounds but have one thing in common – they either improve business productivity or the quality of life.

Point Wizard [1000minds] is one of six finalists for the Global Entrepolis@Singapore Award, presented by The Asian Wall Street Journal in association with the Economic Development Board of Singapore.

Point Wizard [1000minds] won the 2005 TUANZ Healthcare Award.

Announcing a new software program designed to provide more accurate rankings of alternatives or individuals and better decision-making.

Can’t find what you’re looking for? Contact us.