Project selection involves a disciplined approach when prioritizing projects, to ensure that the organization’s resources are expended in a way that maximizes the resulting benefits and minimizes any negative outcomes. In this article, we will explore what project selection is, why it is important, and the different project selection methods that organizations can use to make informed decisions.

What is project selection?

Project selection is the process of evaluating potential projects and choosing the ones that are most likely to deliver the desired outcomes and benefits. It involves identifying the projects that align with an organization’s strategic goals, mission and vision. The process of project selection also involves assessing the feasibility, risks and potential return on investment of each project.

Why is project selection important?

Project selection is a critical step in the project management process. It helps organizations to allocate their resources effectively and efficiently, which leads to better outcomes and increased success rates. A well-selected project can bring numerous benefits, including increased revenue, improved productivity and enhanced customer satisfaction. Additionally, selecting the right project ensures that an organization’s resources, including time, money and human capital, are used effectively.

Project selection methods

There are several methods that organizations can use to select the right project. A few commonly used methods are summarized below.

Cost-benefit analysis and value for money

Cost-benefit analysis involves comparing the benefits of a project against the costs or resources it requires, in order to determine whether the project is worth pursuing based on its “value for money” or efficiency.

A cost-benefit analysis involves calculating, at least implicitly, a benefit-cost ratio (BCR) for each project being considered. A BCR is simply the value of a project’s benefits divided by its costs: i.e. the ratio of benefits to costs. The projects’ benefits are often represented on multiple quantitative or qualitative dimensions or criteria of importance to decision-makers which are combined into a overall index value, e.g. out of 100. The costs are usually in monetary terms, in “present value” terms where possible – which simply means that, for consistency, they are measured in monetary values for the same point in time, such as at the start of the project.

A BCR – benefit-cost ratio – greater than one indicates that the project is worthwhile pursuing: because the benefits exceed the costs. Though, of course, other projects may have higher BCRs, and so be even more worthwhile, i.e. more efficient.

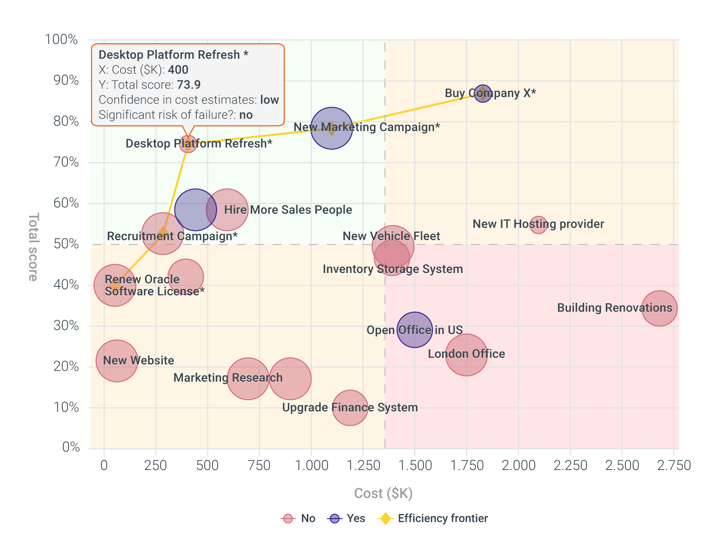

A powerful and intuitive way to visualize your cost-benefit analysis is to use a value-for-money chart, where your projects’ benefits are represented on the y-axis and their costs are on the x-axis. An example of a value-for-money chart from 1000minds software is shown below, where such a chart can easily accommodate many dozens, even potentially hundreds, of projects you are comparing.

This chart also allows you to easily incorporate other considerations into your cost-benefit analysis that might not necessarily be classified as benefits or costs but that are likely to be relevant for your final project selection decisions, such as “confidence in cost estimates”, “risk of failure”, “departmental category” or “region”, etc. These other considerations can be represented in the value-for-money chart by the size and color of the bubbles (as below).

Clearly, in pursuit of maximum value for money, the focus of attention is in the chart’s top-left quadrant: i.e. high Total Scores (benefits) and low Costs. Possible tradeoffs are along the gold line, known as the efficiency, or Pareto, frontier: higher Costs can be “compensated for” by higher Benefits. All projects on the frontier “dominate” others with respect to their benefits and costs (as represented on the chart’s axes).

This framework can be used to answer important questions like these. How would you answer these questions?

- With a budget of, say, $25 million, which projects in the chart would you select?

- Which projects represent high-quality and low-quality spending respectively?

- Which projects are good value for money?

You can try different combinations of projects to create an “optimal portfolio”, perhaps also addressing other goals such as selecting at least one proposal from each department.

Scoring models

Scoring models is an advanced project selection method that involves assigning scores to projects based on predetermined project selection criteria. This approach enables organizations to incorporate both quantitative and qualitative objectives into their analysis, creating a scientifically robust project selection model even when criteria are “fuzzy” or difficult to measure. Thus, all relevant considerations, including risk, benefit and feasibility, can be included in the project selection process. Often facilitated by specialized decision-making software, scoring models are weighted using a variety of methods. Learn more about scoring models and criteria weighting methods.

1000minds decision-making software incorporates scoring models to assist in the project selection process (as well as any other big decision you might need to make). 1000minds implements its award-winning, patented PAPRIKA algorithm in order to elicit decision-maker and stakeholder preferences and determine criterion weights accordingly.

The PAPRIKA method involves the decision-maker answering a series of simple pairwise ranking questions based on choosing between two hypothetical alternatives, initially defined on just two criteria at a time. The levels on the criteria are specified so that there is a trade-off between the criteria.

Figure 2 is an example of such a pairwise ranking trade-off question – involving choosing between projects for a business, nonprofit or government organization.

PAPRIKA was developed to make decisions as cognitively easy as possible while remaining scientifically robust. Indeed, choosing one alternative from two, defined on just two criteria at a time, is the easiest possible decision in the universe! In contrast, other scoring models may rely on the decision-maker directly rating the criteria according to their preferences, which is cognitively more difficult and leads to less accurate results. PAPRIKA has been recognized in eight innovation awards and is patented in the US, New Zealand and Australia.

Discounted cash flow

Discounted cash flow (DCF) analysis is a project selection method that seeks to estimate the present value of future cash flows based on the time value of money. It works by discounting projected cash inflows and outflows using a discount rate that represents the expected rate of return for the investment. The resulting net present value (NPV) represents the value of the investment today.

DCF is commonly used for project selection by analyzing the NPV of different investment opportunities and selecting the project with the highest NPV. A positive NPV indicates that the project is expected to generate more cash than the initial investment, while a negative NPV indicates that the project is expected to lose money. By using DCF, decision-makers can evaluate the potential profitability of a project and make informed investment decisions. However, it’s important to note that DCF analysis relies heavily on assumptions about future cash flows and discount rates, which may not always be accurate.

Payback period

The payback period method is a financial analysis technique used to select projects based on the time it takes for a project to recover its initial investment through cash inflows. It works by dividing the initial investment by the expected annual cash inflows to determine how many years it will take to pay back the investment. The resulting payback period represents the time it takes to recover the initial investment.

The payback period method is a quick and simple way to assess the financial viability of an investment. Projects with shorter payback periods are typically considered more attractive because they generate cash flow faster and pose less risk. However, the payback period method does not take into account the time value of money or the cash inflows beyond the payback period. Therefore, it’s important to use other financial analysis methods in conjunction with the payback period method to make informed investment decisions in project selection.

Opportunity costs

Another project selection method is calculating the opportunity costs involved in selecting a project over another. This cost refers to the potential benefits that are missed out on by choosing to invest in the selected project instead of another alternative. Usually, the cost is calculated by determining the possible returns on the best foregone option and subtracting the returns on the chosen option.

While taking into account opportunity costs helps decision-makers make informed investment decisions, it’s important to consider other factors such as the risk associated with the investment, the time horizon and the impact on the organization’s strategic goals before making a final decision. In particular, opportunity costs should only be calculated for projects of similar risk. Additionally, calculating opportunity cost can be difficult because it involves estimating future returns, which are not precisely known at present.

Conclusion

Project selection is a crucial process that any business or organization faces when determining how to allocate resources. By carefully selecting the right projects, organizations can ensure that they are making the most of their resources and achieving their strategic objectives. The methods outlined in this article provide organizations with valuable tools to help them make informed decisions when selecting projects.

Try 1000minds!

Step up your approach to project selection with 1000minds, which combines a scoring model with cost-benefit analysis to make decisions in a robust, fair, and transparent way. Try a free 15-day-trial today, or book a free demo to see how 1000minds can help you optimize your project selection process.

Share this post on: