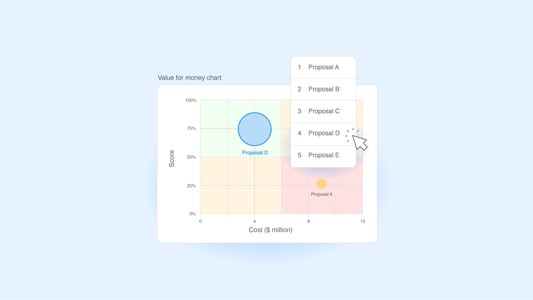

Creating an ethical decision-making model for your organization

An ethical decision-making model helps organizations navigate priorities in a way that aligns with their core values and ethical principles. But building such a model involves many challenges.